Does Insurance Cover Hormone Testing? Complete Coverage Guide 2024

Learn about insurance coverage for hormone testing, including what tests are covered, factors affecting coverage, and strategies to maximize your benefits for hormone-related healthcare.

R2 Medical Team • June 25, 2025 • 12 min read

# Does Insurance Cover Hormone Testing? Complete Coverage Guide 2024

Hormone testing has become increasingly important for diagnosing and treating various health conditions, from thyroid disorders to hormone imbalances affecting metabolism, mood, and overall wellness. Many patients considering hormone testing wonder whether their insurance will cover these essential diagnostic tests. The answer depends on several factors, including your insurance plan, the medical necessity of testing, and how your healthcare provider approaches the diagnostic process.

Understanding insurance coverage for hormone testing can help you make informed decisions about your healthcare and avoid unexpected medical bills. This comprehensive guide explores what hormone tests are typically covered, factors that influence coverage, and strategies to maximize your insurance benefits for hormone-related healthcare.

**Medical Disclaimer:** This information is provided for educational purposes only and should not replace professional medical or insurance advice. Always consult with your healthcare provider and insurance company to understand your specific coverage and medical needs.

## Understanding Hormone Testing and Medical Necessity

Insurance companies typically cover hormone testing when it's deemed medically necessary by a healthcare provider. Medical necessity means the testing is required to diagnose, treat, or monitor a health condition that could affect your well-being. Most insurance plans, including Medicare and Medicaid, follow this principle when determining coverage.

### Common medically necessary hormone tests include:

- **Thyroid function tests (TSH, T3, T4)** - Often covered for symptoms like fatigue, weight changes, or suspected thyroid disorders

- **Testosterone levels** - Typically covered when diagnosing hypogonadism, erectile dysfunction, or unexplained fatigue in men

- **Estrogen and progesterone** - Usually covered for menstrual irregularities, menopause symptoms, or fertility issues

- **Cortisol testing** - Often covered when investigating adrenal disorders or chronic stress-related symptoms

- **Insulin and glucose testing** - Commonly covered for diabetes screening and management

- **Growth hormone testing** - May be covered for suspected growth hormone deficiency in children and adults

The key to insurance coverage lies in proper documentation of symptoms and medical justification. Healthcare providers must demonstrate that hormone testing is necessary based on your medical history, physical examination, and presenting symptoms.

## Types of Insurance Plans and Coverage Differences

Different insurance plan types handle hormone testing coverage in varying ways, affecting your out-of-pocket costs and approval requirements.

### Health Maintenance Organization (HMO) Plans

HMO plans typically require referrals from your primary care physician (PCP) for specialist care and specialized testing. For hormone testing:

- Your PCP must determine medical necessity and either order tests directly or refer you to an endocrinologist

- Coverage is usually good for medically necessary tests when properly referred

- You'll need to stay within your plan's network of providers and laboratories

- Prior authorization may be required for expensive or specialized hormone panels

### Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility in choosing healthcare providers and typically provide:

- Direct access to specialists without referrals, allowing you to see an endocrinologist directly

- Coverage for both in-network and out-of-network providers, though out-of-network costs are higher

- Generally broader coverage for hormone testing when medically justified

- Less restrictive prior authorization requirements compared to HMO plans

### High-Deductible Health Plans (HDHP)

HDHPs require you to pay more out-of-pocket before insurance coverage begins:

- You'll pay the full cost of hormone testing until meeting your deductible

- After meeting the deductible, you typically pay coinsurance (usually 10-20% of the cost)

- Preventive care may be covered at 100% even before meeting your deductible

- Health Savings Account (HSA) funds can be used to pay for hormone testing expenses

## Medicare and Medicaid Coverage for Hormone Testing

### Medicare Coverage

Medicare Part B typically covers hormone testing when medically necessary:

- **Medicare Part B** covers outpatient hormone tests ordered by your doctor for diagnostic purposes

- **Medicare Advantage plans** may offer additional coverage or different cost-sharing arrangements

- You'll typically pay 20% coinsurance after meeting your Part B deductible

- Medicare covers annual wellness visits that may include some hormone screening

### Medicaid Coverage

Medicaid coverage varies by state but generally includes:

- Medically necessary hormone testing with minimal or no out-of-pocket costs

- Coverage for both primary care and specialist-ordered tests

- Prior authorization requirements may apply for expensive hormone panels

- Emergency Medicaid may cover urgent hormone testing related to acute conditions

## Factors That Influence Insurance Coverage

Several factors determine whether your insurance will cover hormone testing and how much you'll pay out-of-pocket.

### Medical Documentation and ICD-10 Codes

Your healthcare provider must use appropriate diagnostic codes (ICD-10) that support the medical necessity of hormone testing:

- **Specific symptoms** must be documented (fatigue, weight changes, mood disorders)

- **Clinical findings** from physical examination should support testing needs

- **Previous treatment history** may influence coverage decisions

- **Family history** of hormone-related conditions can support testing justification

### Provider Network Status

The healthcare provider ordering your tests and the laboratory performing them significantly impact coverage:

- **In-network providers and labs** result in lower out-of-pocket costs

- **Out-of-network testing** may result in higher coinsurance or full payment responsibility

- **Preferred laboratories** often have negotiated rates with insurance companies

- **Hospital-based labs** may have different coverage rules than independent laboratories

### Test Complexity and Cost

Insurance companies scrutinize expensive or comprehensive hormone panels more carefully:

- **Basic hormone tests** (TSH, testosterone) are usually covered without issues

- **Comprehensive hormone panels** may require prior authorization

- **Specialized tests** (24-hour cortisol, growth hormone stimulation tests) often need additional justification

- **Repeated testing** within short timeframes may face coverage limitations

## Commonly Covered Hormone Tests by Insurance

### Thyroid Function Tests

Most insurance plans readily cover thyroid testing due to the high prevalence of thyroid disorders:

- **TSH (Thyroid Stimulating Hormone)** - Nearly universally covered for symptoms or routine screening

- **Free T4 and T3** - Usually covered when TSH is abnormal or symptoms persist

- **Thyroid antibodies** - Often covered when investigating autoimmune thyroid conditions

- **Reverse T3** - May require additional justification for coverage

### Reproductive Hormone Testing

Coverage for reproductive hormones typically depends on age, gender, and presenting symptoms:

- **Testosterone testing in men** - Well-covered for symptoms of low testosterone

- **Estrogen and progesterone** - Usually covered for menstrual issues or menopause

- **FSH and LH** - Often covered for fertility evaluations or hormonal imbalances

- **DHEA-S** - May be covered when investigating adrenal function

### Metabolic Hormone Testing

Tests related to metabolism and blood sugar regulation are typically well-covered:

- **Insulin and C-peptide** - Usually covered for diabetes evaluation

- **HbA1c** - Widely covered for diabetes screening and monitoring

- **Leptin and adiponectin** - May require specific justification for coverage

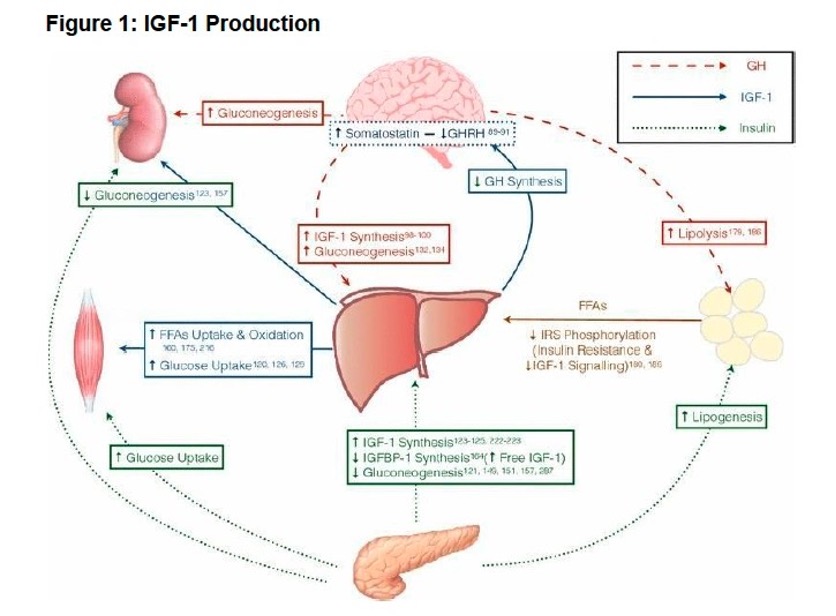

- **IGF-1** - Often covered when investigating growth hormone issues

## Tests That May Face Coverage Challenges

Certain hormone tests may face insurance coverage challenges due to cost, controversy, or limited evidence supporting their routine use.

### Anti-Aging and Wellness Testing

Insurance typically doesn't cover hormone testing for general wellness or anti-aging purposes:

- **Comprehensive hormone panels** ordered without specific symptoms

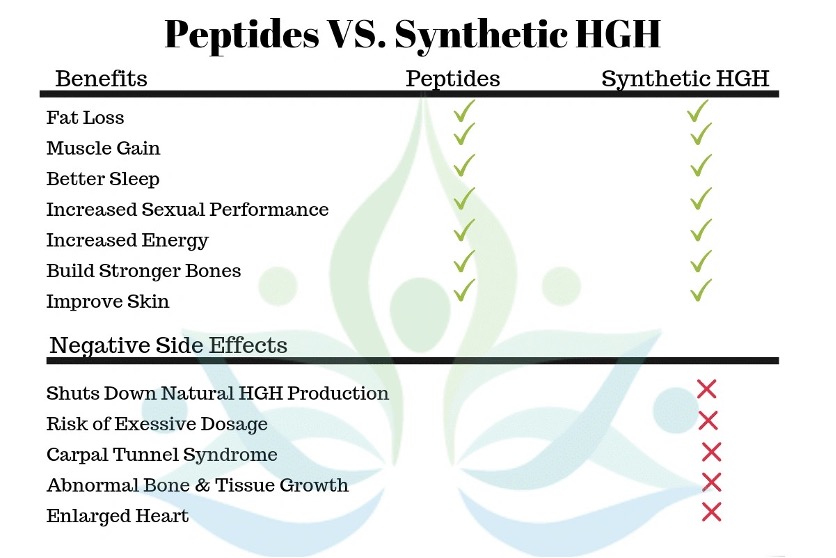

- **Growth hormone testing** for anti-aging rather than deficiency diagnosis

- **Advanced hormone metabolite testing** without clear medical indication

- **Saliva hormone testing** may face coverage limitations compared to blood tests

### Alternative and Functional Medicine Testing

Tests commonly ordered by functional medicine practitioners may face coverage issues:

- **24-hour urine hormone testing** - May require specific medical justification

- **Multiple hormone ratios** - Often considered experimental by insurance companies

- **Neurotransmitter testing** - Typically not covered by insurance

- **Heavy metal testing** - Usually not covered unless occupational exposure is suspected

### Experimental or Research-Based Tests

New or experimental hormone tests often lack insurance coverage:

- **Novel biomarkers** not yet established in medical guidelines

- **Genetic testing** for hormone metabolism - Coverage varies widely

- **Micronutrient testing** related to hormone function - Often not covered

- **Specialized panels** from specific laboratories may face coverage challenges

## How to Maximize Your Insurance Coverage

### Work with Your Healthcare Provider

Collaboration with your healthcare provider is essential for maximizing insurance coverage:

- **Document symptoms thoroughly** - Keep detailed records of symptoms, their duration, and impact on daily life

- **Discuss medical history** - Provide complete family and personal medical history related to hormone issues

- **Request proper coding** - Ensure your provider uses appropriate ICD-10 codes that support medical necessity

- **Get referrals when needed** - Obtain proper referrals for specialist care when required by your plan

### Understand Your Insurance Plan

Knowing your plan details helps you make cost-effective decisions:

- **Review your benefits summary** - Understand deductibles, coinsurance, and coverage limits

- **Check provider networks** - Use in-network providers and laboratories when possible

- **Verify prior authorization requirements** - Some tests may require pre-approval

- **Understand appeal processes** - Know how to appeal denied claims if necessary

### Consider Timing and Frequency

Strategic timing of hormone testing can impact coverage and costs:

- **Annual wellness visits** - Some hormone screening may be covered as preventive care

- **Avoid unnecessary repeat testing** - Insurance may deny testing done too frequently

- **Coordinate with other medical care** - Combine hormone testing with other necessary medical visits

- **Plan around deductible periods** - Consider timing if you have a high-deductible plan

## Out-of-Pocket Costs and Payment Options

Understanding potential costs helps you budget for hormone testing and explore payment alternatives.

### Typical Cost Ranges

Hormone testing costs vary significantly based on the specific tests and your location:

- **Basic thyroid panel (TSH, T4)** - $50-$200 without insurance

- **Comprehensive metabolic panel** - $100-$300 without insurance

- **Testosterone testing** - $50-$150 without insurance

- **Extensive hormone panels** - $300-$1,000+ without insurance

- **Specialized tests** - Can exceed $500-$1,500 for complex panels

### Insurance Cost-Sharing

Even with insurance coverage, you may have out-of-pocket expenses:

- **Copays** - Fixed amounts (typically $10-$50) for laboratory services

- **Coinsurance** - Percentage of costs (usually 10-20%) after meeting deductible

- **Deductibles** - Full cost until reaching annual deductible amount

- **Out-of-network penalties** - Higher costs for non-network providers

### Payment Assistance Programs

Several options can help reduce out-of-pocket costs:

- **Laboratory discounts** - Many labs offer self-pay discounts for uninsured patients

- **Health Savings Accounts (HSAs)** - Use pre-tax dollars for medical expenses

- **Flexible Spending Accounts (FSAs)** - Employer-sponsored accounts for medical costs

- **Patient assistance programs** - Some pharmaceutical companies offer testing assistance

- **Clinical trials** - May provide free hormone testing as part of research studies

## Steps to Take Before Getting Hormone Testing

### Verify Insurance Coverage

Before scheduling hormone testing, take these important steps:

1. **Call your insurance company** - Verify coverage for specific tests and providers

2. **Check prior authorization requirements** - Some tests may need pre-approval

3. **Confirm network status** - Ensure providers and labs are in-network

4. **Understand cost-sharing** - Know your deductible, copay, and coinsurance amounts

5. **Get estimates** - Request cost estimates from healthcare providers

### Prepare for Your Appointment

Proper preparation can improve your chances of insurance coverage:

- **Document symptoms** - Create a detailed list of symptoms and their timeline

- **Gather medical records** - Bring relevant previous test results and medical history

- **List medications** - Include all prescriptions, supplements, and over-the-counter drugs

- **Prepare questions** - Ask about test necessity, alternatives, and expected costs

- **Understand results** - Discuss how results will guide treatment decisions

## Working with R2 Medical Clinic for Hormone Testing

At R2 Medical Clinic, we understand the importance of hormone testing in optimizing your health and wellness. Our experienced healthcare providers work with you to ensure appropriate testing while maximizing your insurance benefits.

### Our Insurance Support Services

- **Insurance verification** - We verify coverage before scheduling tests

- **Prior authorization assistance** - Our staff helps obtain necessary approvals

- **Proper documentation** - We ensure medical necessity is clearly documented

- **Cost transparency** - We provide clear estimates of your potential costs

- **Payment options** - We offer various payment plans and assistance programs

### Comprehensive Hormone Testing Services

Our clinic provides extensive hormone testing services:

- **Thyroid function comprehensive panels**

- **Male and female hormone optimization testing**

- **Adrenal function evaluation**

- **Metabolic hormone assessment**

- **Specialized testing for hormone replacement therapy monitoring**

### Insurance Collaboration

We work with major insurance providers and understand their requirements:

- **Proper coding and documentation** to support medical necessity

- **Evidence-based testing protocols** that align with insurance guidelines

- **Cost-effective testing strategies** to minimize your out-of-pocket expenses

- **Appeal support** if coverage is initially denied

## Tips for Appealing Denied Claims

If your insurance initially denies coverage for hormone testing, you have options:

### Internal Appeals Process

- **Review the denial letter** - Understand the specific reason for denial

- **Gather supporting documentation** - Collect medical records that support necessity

- **Submit a formal appeal** - Follow your insurance company's appeal process

- **Include provider support** - Ask your doctor to provide additional justification

- **Set deadlines** - Most appeals must be filed within 60-180 days

### External Review Options

If internal appeals fail, you may have additional options:

- **State insurance commissioner** - File complaints about unfair denials

- **Independent medical review** - Request evaluation by external medical experts

- **Legal consultation** - Consider legal advice for complex coverage disputes

- **Healthcare advocacy services** - Professional advocates can help navigate appeals

## Conclusion

Insurance coverage for hormone testing depends on medical necessity, your specific insurance plan, and proper documentation by your healthcare provider. While most medically necessary hormone tests are covered by insurance, understanding your plan's requirements and working with experienced healthcare providers can help maximize your benefits and minimize out-of-pocket costs.

At R2 Medical Clinic, we're committed to helping you access the hormone testing you need while working within your insurance benefits. Our team understands the complexities of insurance coverage and will work with you to ensure you receive appropriate care at the most affordable cost.

Don't let insurance concerns prevent you from getting the hormone testing you need. Contact R2 Medical Clinic today to discuss your hormone health needs and learn how we can help you navigate insurance coverage for comprehensive hormone testing.

**Medical Disclaimer:** This article provides general information about insurance coverage and should not replace personalized medical or insurance advice. Coverage varies significantly between insurance plans and individual circumstances. Always consult with your healthcare provider and insurance company to understand your specific coverage and medical needs. The information provided is current as of 2024 and may change as insurance policies and medical guidelines evolve.

## Frequently Asked Questions

### Q1: Does insurance cover hormone testing for anti-aging purposes?

Insurance typically does not cover hormone testing performed solely for anti-aging or wellness optimization purposes. Coverage usually requires documented symptoms and medical necessity as determined by your healthcare provider.

### Q2: How often will insurance cover hormone testing?

Coverage frequency depends on your medical condition and insurance plan. Routine monitoring may be covered annually or more frequently if medically necessary. Your healthcare provider can help determine appropriate testing intervals.

### Q3: What should I do if my insurance denies coverage for hormone testing?

If coverage is denied, review the denial letter to understand the reason, gather supporting medical documentation, and file an appeal with your insurance company. Your healthcare provider can assist with additional justification for medical necessity.

### Q4: Are saliva hormone tests covered by insurance?

Saliva hormone tests may face coverage challenges compared to blood tests. Insurance companies often prefer blood-based testing as it's more standardized and widely accepted in medical practice.

### Q5: Does Medicare cover hormone replacement therapy monitoring?

Medicare typically covers medically necessary hormone testing, including monitoring for hormone replacement therapy when prescribed by a healthcare provider. You'll usually pay 20% coinsurance after meeting your Part B deductible.

Ready to Start Your Health Journey?

Our expert medical team is here to help you achieve optimal health and wellness through personalized treatment plans.